Summary:

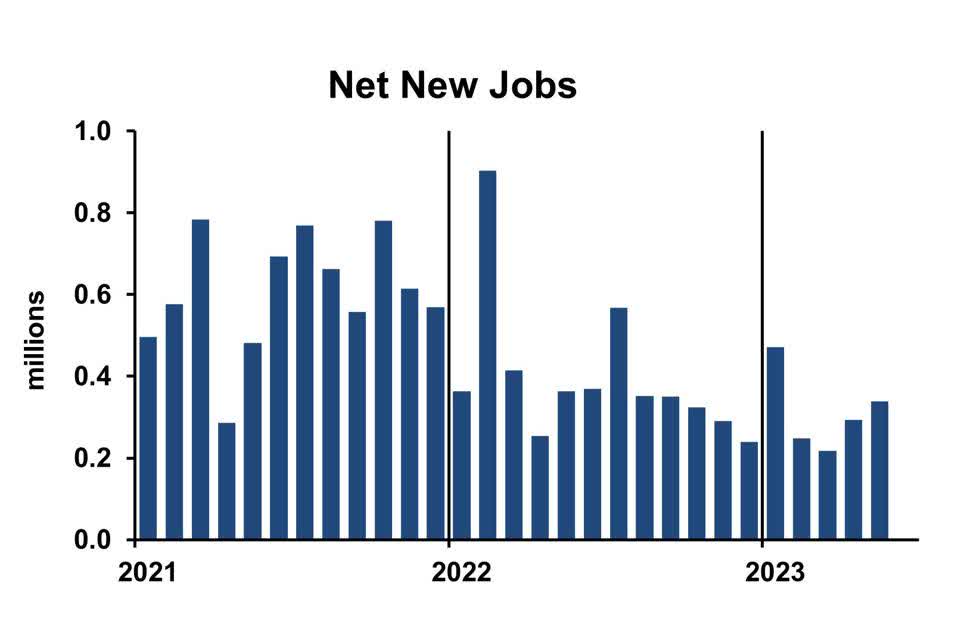

- The US economy is still expanding and shows no signs of slowing down, and wage inflation is still significantly higher than what is fair.

- The risks of overshooting because of delays in the effects of monetary policy must be weighed against the dangers of doing too little at first by the Federal Reserve.

- Despite worries over recent bank failures, the Fed is likely to keep raising interest rates in an effort to achieve its 2% inflation target.

The economy is still growing, with no signs of slowing down, according to the May employment data. Although wage inflation has decreased from its peak in 2022, the most recent monthly data reveal that it is still substantially over realistic targets. And the April consumer expenditures price index indicated that there hasn't been any improvement recently.

The monetary policy committee of the Federal Reserve will convene on June 13 and 14. Officials have made suggestions that they might stop the Fed from raising interest rates, but they have also emphasized that they will take the most recent data into account. Following the May meeting, Fed chair Jerome Powell stated, "Looking forward, we will take a data-dependent approach in determining the extent to which additional policy firming may be appropriate."

Given the lengthy time lags associated with monetary policy, some Fed decision-makers have questioned whether it is appropriate to wait. The economy is affected by a monetary policy with a one-year time lag. They can be in a precarious position where their past choices are about to come back to haunt them, and any further action would be disastrous.

Analyzing time lags is tricky. Historical data demonstrate variable effect sizes and time lags. When predicting the economy, economists frequently make subjective changes to their models to reflect how they think the current situation differs from the circumstances in the past, leading to average impacts and time lags.

While the one-year time lag is a useful heuristic, the actual influence is spread out across time, beginning with minor impacts, increasing to a maximum effect, and then diminishing to small effects much later than a year. The effects of inflation take significantly longer to materialize—about two years after a Fed decision.

The Fed must now decide between the risks of overshooting due to those time lags and not doing enough initially. More consistency may be found here. The majority of the regional Federal Reserve bank presidents and governors have expressed support for their "risk management perspective." They have examined the costs of too-easy and too-tight monetary policies.

Despite their desire to create the ideal policies, their initial predictions that inflation would be temporary have caused them to become more modest. Inflation is significantly tougher to combat once it has solidly taken root in customers, employees, and company decision-makers' expectations, according to economic history and established economic theory.

Therefore, being too tight runs the danger of a minor economic slowdown, while being too loose might necessitate a severe recession to reverse the inflationary mindset. When the Fed is unsure, they will tighten or at the very least maintain high-interest rates.

The Fed's economists are concerned about the effects of recent bank failures, such as Silicon Valley Bank. Perhaps the financial sector's troubles will cause the economy to slow down, negating the need for future interest rate increases.

According to the study of senior lenders conducted by the Fed, banks are tightening their loan requirements. However, a historical analysis of the poll reveals that current developments are consistent with earlier periods of impending economic deterioration. that, despite the bank collapse, something out of the ordinary is happening. This survey, though, is a fairly sloppy indicator.

In light of all available data, the Fed is expected to keep raising interest rates. Look for a rate hike in July if they do decide to pause at the June meeting, which is unlikely but certainly possible.

My own calculations demonstrate that, given historical relationships, the Fed may raise short-term interest rates by another half percentage point and then maintain them high for a whole year without exceeding its target inflation rate of two percent. Although it's not clear how we'll proceed, it's an excellent place to start when doing more research.